n early 2021, GCash, an e-wallet known as the Philippine version of “Alipay”, raised more than US$175 million from New York private equity fund Bow Wave Capital Management. After the financing, Gcash’s valuation exceeded US$1 billion, making it a unicorn company in the payment industry.

GCash is an e-wallet under the Philippine telecommunications company Globe, and is also supported by Ant Financial, especially in terms of payment technology. In the early stage of cooperation, Alipay sent a team of more than 30 people to empower GCash, bringing many perfect technologies and rich experience including Ant Data Platform, Alibaba Cloud’s underlying infrastructure, Alipay’s security, risk control model, etc. Even Jack Ma personally went to the Philippines to promote GCash, downloading GCash and scanning the merchant’s QR code to demonstrate the convenience of payment.

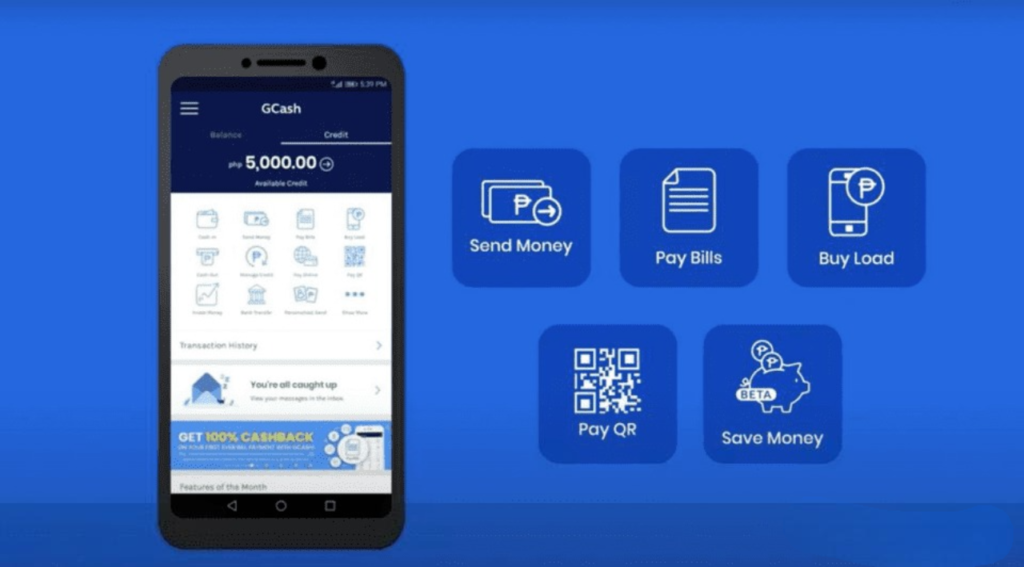

Features of Gcash

The functions of GCash are very similar to those of Alipay, including regular bill payments, P2P reception, transfer services, merchant payments, and payroll, and even credit card services.

Bill payment: Gcash includes daily mobile phone recharges, utility bills, credit cards, government bill payments, and some school tuition bills can also be paid through Gcash.

P2P lending: GCash small loan function. As a country with the habit of pre-consumption, more than 80% of Filipino adults have borrowed money, and 47% of them are called serial borrowers. P2P is very important to many people in the Philippines.

Transfer business: Allow users to transfer money, whether to the same bank or across banks, it is free, and there is no requirement for customers to hold a minimum balance in their accounts.

Merchant payment: widely connected to online shopping systems such as LAZADA in the Philippines, online ticketing, etc., and also widely used offline. Tens of thousands of merchants have connected to GCash for payment, and support GCash and Alipay “one code two scans”

Payroll: GCash also assists companies in providing payroll solutions to easily manage corporate expenditures. Service scope: salary payment, performance incentives, job allowances, etc.

Registered GCash users can also apply for Gcredit cards, MasterCards and American Express cards (virtual cards), and can also directly connect to PayPal through their accounts, conveniently and quickly access funds in PayPal. Through GCASH American Express virtual payment, customers can purchase electronic goods and services on international websites.

Why is Gcash worth accessing?

As the largest e-wallet in the Philippines, the latest official data shows that it has 33 million users, equivalent to 30% of the Philippine population, and the growth rate is as high as 50% compared with previous years. It tends to dominate the e-wallet field in the Philippines and has amazing potential.

With strong technical support from Ant Financial, GCash has extremely rich functions and a smooth experience. Its payment success rate is the highest among all e-wallets in the Philippines, and it has a very good reputation among merchants and the public.

The application scenarios not only cover domestic online and offline businesses in the Philippines, but also allow the purchase of international products and services through the American Express card in the wallet, which is a function that most e-wallets do not have.

Therefore, for companies going to the Philippines, it is very necessary to connect to GCash, which has the most important features of large user coverage, stable technology, and rich usage scenarios.

How to access Gcash?

Currently, you can access GCash through a third-party gateway (please contact Okpay for details). The third-party gateway integrates local popular payment methods to solve all payment problems at once. The payment process is convenient and simple.

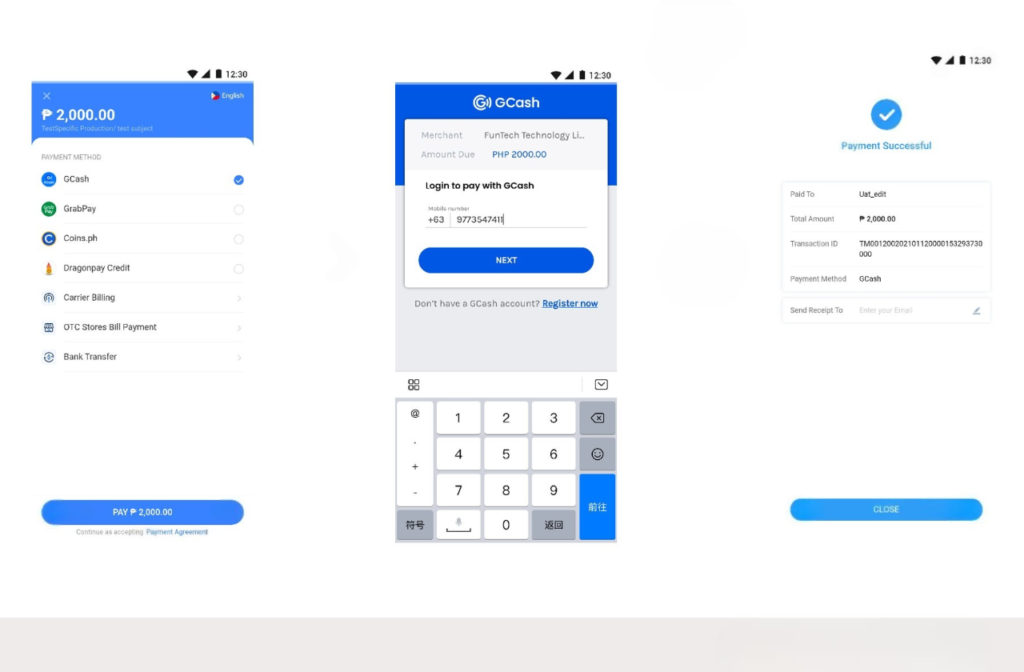

Payment process after GCash access

After the merchant connects to the Okpay cashier, the user submits the order on the platform

1. Select GCash at the cashier and click pay to proceed to the next step

. 2. Fill in your mobile number and enter the 4-digit MPIN code after receiving the 6-digit SMS verification code.

3. Payment completed

For overseas merchants, local payment is an urgent need. GCash is widely used, and is very suitable for overseas digital entertainment such as e-commerce, live broadcasting, games, and online reading.

The above is an introduction to GCash, a local payment platform in the Philippines. If you need to know more about payment information in the Philippines, you can contact Okpay Payment.